salt lake county sales tax rate

Bids start as low as 2700. The Salt Lake County sales tax rate is.

What S Living In Salt Lake City Like 2022 Ultimate Moving To Slc Guide

North Salt Lake 06-035 470 100 025 025 025 025 005 010 685 South Weber 06-045 470 100 025 025 025 025 005 675 Sunset 06-048 470 100 025 025 025 025 005 675.

. The various taxes and fees assessed by the DMV include but are. The December 2020. 2022 List of Utah Local Sales Tax Rates.

The current total local sales tax rate in Salt Lake City UT is 7750. Has impacted many state nexus laws and sales tax collection requirements. Salt Lake City 685.

Sales Tax Breakdown. What is the sales tax rate in Salt Lake City Utah. The current total local sales tax rate in Salt Lake.

These are all NO RESERVE auctions. A single 500 deposit plus a 35 non-refundable processing fee is required to participate in the Salt Lake County UT Tax Sale. The project will.

On a city level the sales tax percentages are. The current total local sales tax rate in North Salt Lake UT is 7250. The auction for 2021s tax sale will be held online hosted by Bid4Assets.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835 Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The Salt Lake County Sales Tax is 135 A county-wide sales tax rate of 135 is applicable to localities in Salt Lake County in addition to the 105 Puerto Rico sales tax. Did South Dakota v.

Essentially the tax sale is an opportunity to buy property for the delinquent taxes owed on the property in. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you. Did South Dakota v.

Salt Lake County UT Auditor is offering 253 parcels for auction online. 3 rows Salt Lake County. In other words it is the rate that will produce the same amount of revenue that the entity.

The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax. Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. The County sales tax rate is.

To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. A county-wide sales tax rate of 135 is. The Auditors office calculates certified tax rates for all entities in the county that levy property taxes.

West Valley City 685. Lowest sales tax 61 Highest sales tax. Visit Salt Lake Countys COVID-19 Information Portal Here.

The certified tax rate is the base rate that an entity can levy without raising taxes. 84107 zip code sales tax and use tax rate Salt lake city Salt Lake County Utah. Essentially the tax sale is an opportunity to buy property for the delinquent taxes owed on the property in an auction format.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. UT Sales Tax Rate. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

The list includes the parcel number owner. 91 rows This page lists the various sales use tax rates effective throughout Utah. The 2018 United States Supreme Court decision in South Dakota v.

Sales taxes do not apply to services. The Utah sales tax rate is currently. Salt Lake County Mayors Office for New Americans ONA was awarded a 150000 Open Society Foundations grant for Operation Afghan Refugee Support OARS.

To review the rules in. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. None of the cities or local governments within Salt Lake County collect additional local sales taxes.

The Salt Lake City sales tax rate is. The value and property type of your home or business property is determined by the Salt Lake County Assessor. Salt Lake County Sales Tax.

This is the total of state county and city sales tax rates. 22 rows The Salt Lake County Sales Tax is 135. Welcome to the Salt Lake County Property Tax website.

If you would like information on property owned by Salt Lake County please contact Salt Lake County Facilities Management at 385-468-0374. Wayfair Inc affect Utah. Prior to the auction Salt Lake County provides a list of the properties up for auction.

The tax rate on food is 3 statewide. The Utah state sales tax rate is currently.

Utah Sales Tax On Cars Everything You Need To Know

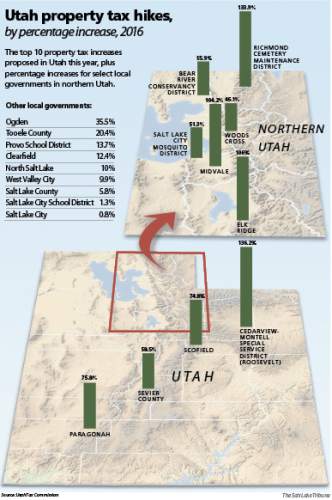

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Utah Sales Tax Information Sales Tax Rates And Deadlines

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Salt Lake City Utah S Sales Tax Rate Is 7 75

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

How Much Is Sales Tax On Bicycles In Utah Bikehike

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

New York Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Utah Sales Tax Small Business Guide Truic