proposed federal estate tax changes 2021

The current federal transfer tax law allows individuals to transfer 118 million free of federal estate and gift tax to their heirs or beneficiaries but that is currently set to expire on. Heres a breakdown of last years income.

The Future Of The Federal Estate Tax 2021 And Beyond

The estates of wealthy Americans will also get a bigger break in 2023.

. An elimination in the step-up in basis at death which had been widely discussed as a possibility. The basic exclusion amount. The Biden Administration has proposed significant changes to the.

Here is what we know thats proposed. July 13 2021 The current 2021 gift and estate tax exemption is 117 million for each US. 2022 tax brackets for individuals.

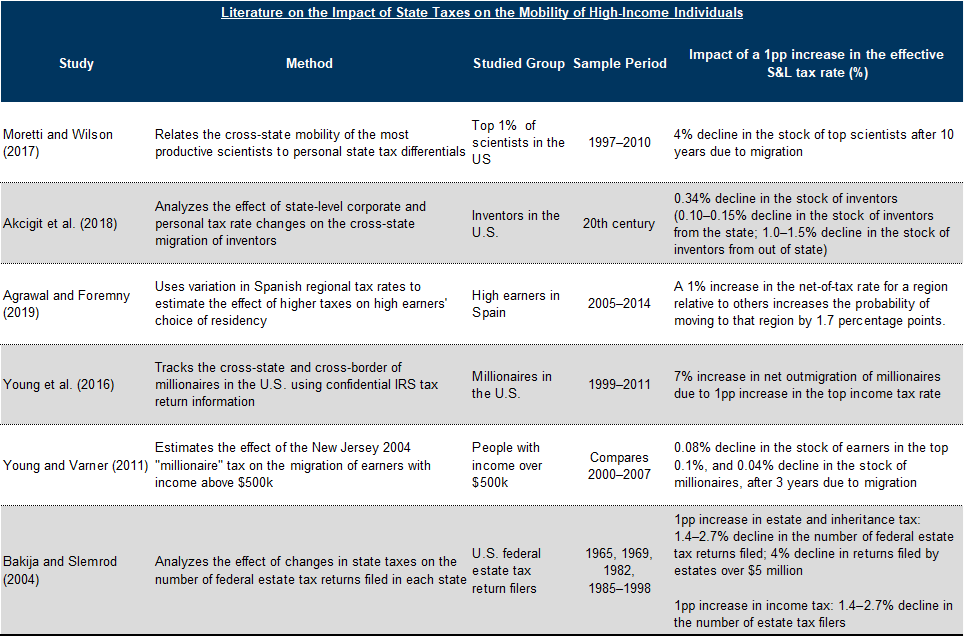

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Net Investment Income Tax would be broadened. The Sanders bill would.

The maximum estate tax rate would increase from 39 to 65. A surcharge of 5 has been proposed for adjusted gross income AGI in. President biden has proposed major changes to the federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these.

On September 27 2021 the. The exemption applies to total bequests. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

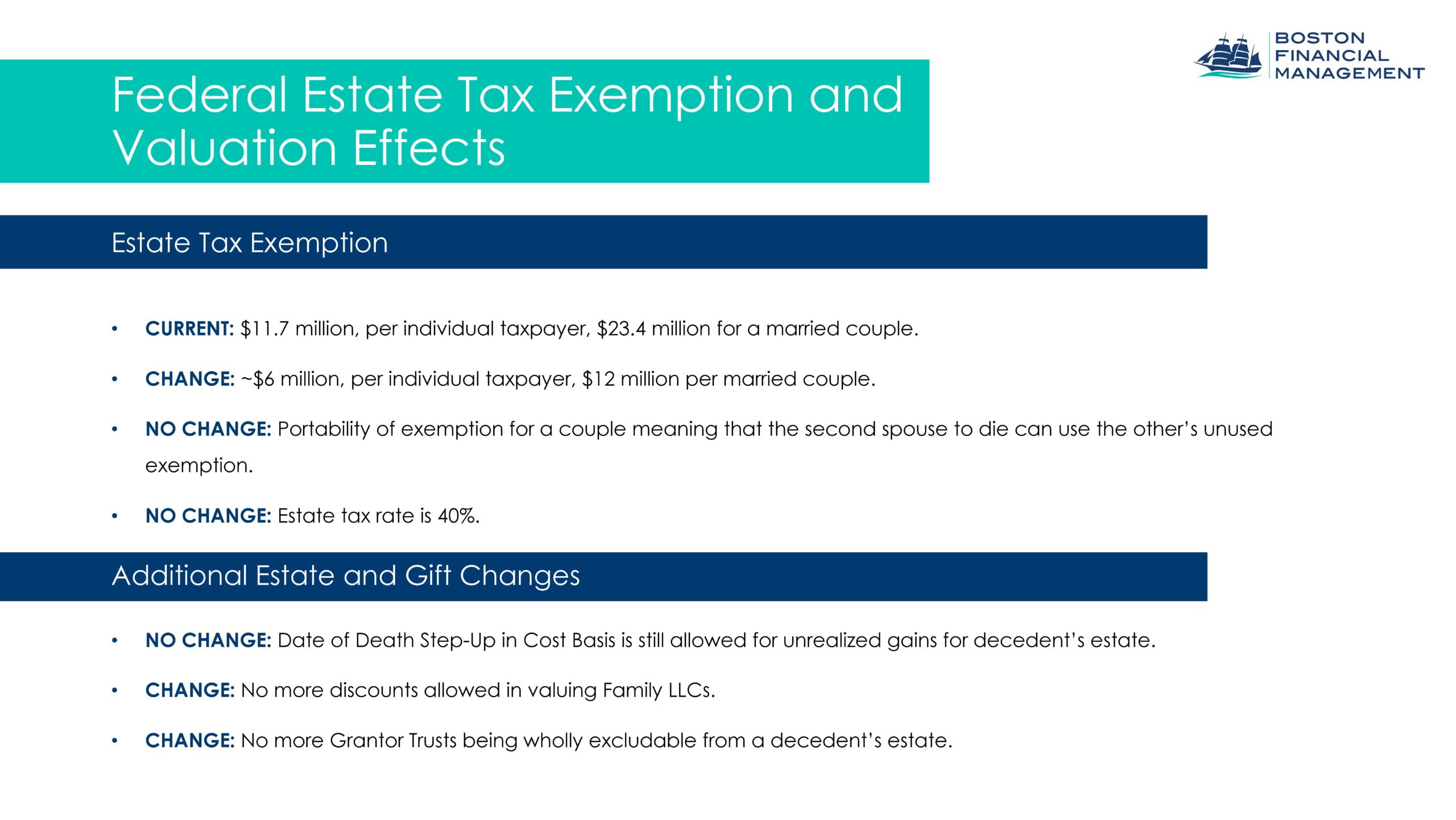

If enacted into law the new estate and gift tax exemptions and rates would apply to estates of decedents dying and gifts made after 31 December 2021. Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. It remains at 40.

Death Tax Repeal Act of 2021 Congressgov. For 2023 as in 2022 2021 2020 2019 and 2018 there is no limitation on itemized deductions as that limitation was eliminated by the Tax Cuts and Jobs Act. The changes could mean tax savings for some taxpayers next year.

Capital gains tax would be increased from 20 to 396 for all income over 1000000. Proposed Estate and Gift Tax Changes. Any modification to the federal estate tax rate.

It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion. This alert provides an overview of proposed gift estate and trust tax changes included in the Build Back Better Act introduced in Sept. Is 117 million in 2021.

The taxable estate is taxed at 40. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021. Federal Estate Tax Rate Under the current proposal the estate tax remains at a flat rate of 40.

Reduced Exemption Amount Current 117 million gift and estate tax exemption. As a result of the proposed tax law. Proposed Changes to Federal Estate Tax.

Each of the tax brackets income ranges jumped about 7 from last years numbers. The proposed adjustment to the sunset provision from 2025 to 2021 would reduce the 117 million lifetime gift tax exemption to 5 million. Conversely a new tax proposal under the Biden administration seeks to reduce the exclusion.

Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax exemption. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3 But it wouldnt be a surprise if the estate tax. Both Senators and Representatives have proposed increasing the tax rate of taxable estates.

Decrease of Estate and Gift Tax Exemption The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. Under a Senate Bill introduced by US. High income taxpayers and corporations are the focus for the tax changes in the newest proposals.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Preparing For The Reduction In The Federal Estate Tax Exemption The Levin Law Firm Philip Levin Esq

Estate Tax In The United States Wikipedia

Us Tax Law Changes Deloitte Us

Biden Tax Plan And 2020 Year End Planning Opportunities

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

No Taxation Without Emigration Briggs

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Estate Tax Current Law 2026 Biden Tax Proposal

2020 Estate Planning Update Helsell Fetterman

Update On Estate And Gift Taxes For 2022 The New Capital Journal New Capital Management

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Estate Tax Law Changes What To Do Now

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Virtual Event Preparing For An Evolving Tax Landscape Boston Financial Management

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

Estate Tax Law Changes Are On Hold For Now

New York S Death Tax The Case For Killing It Empire Center For Public Policy